Defense supply chain vulnerabilities are emerging as the hidden kill switch of modern military power. Rare earths, specialty metals, and advanced microelectronics sit inside every smart weapon and secure network. When a handful of suppliers and refineries control these inputs, they gain leverage over entire armed forces. That risk is now a daily concern for defense ministers, chiefs of staff, and industry leaders.

Why defense supply chain vulnerabilities matter now

Modern forces fight with code, sensors, and chips as much as with platforms. Precision munitions, ISR networks, electronic warfare suites, and secure communications all depend on fragile global supply chains. A disruption in one critical material can slow or stop production across many programs at once.

At the same time, strategic competition is intensifying. Rival powers study the industrial base as carefully as order of battle charts. They look for chokepoints, single suppliers, and geographic concentrations they can exploit in a crisis. In that environment, supply chain resilience is no longer a back-office topic. It is a core element of deterrence.

Rare earth chokepoints: leverage before conflict begins

Rare earth elements sit at the heart of high-end defense technology. They enable radar performance, guidance accuracy, stealth features, motors, and generators. Yet refining capacity for these minerals is highly concentrated in a single country. That concentration gives political leaders a powerful, non-kinetic tool.

We have already seen how export restrictions can disrupt entire industries. A targeted suspension of rare earth shipments can delay sensors, magnets, and other vital subsystems. For defense planners, this is not just a commercial shock; it is a potential constraint on readiness and surge capacity.

Allied institutions now treat these inputs as “defence-critical” materials. They closely monitor availability and price volatility for metals such as rare earths, cobalt, aluminum, and graphite. The lesson is clear: if you cannot guarantee access to these materials, you cannot guarantee the delivery of key platforms and munitions.

Microelectronics: the soft underbelly of high-tech forces

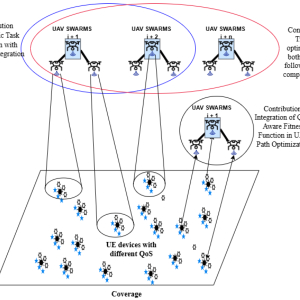

Microelectronics form the nervous system of every advanced military. Chips drive mission computers, sensor fusion, secure radios, datalinks, and electronic warfare systems. A single complex platform may contain thousands of integrated circuits sourced from many countries.

The typical defense microelectronics chain runs across design houses, foundries, packaging plants, distributors, and sub-tier assembly shops. Many of these actors sit outside national borders. Defense ministries often see only the top one or two tiers of this network. They rarely have full visibility into lower tiers, where the true risk often sits.

This structure creates two problems. First, it increases the chance of supply disruption if a few foundries or logistics hubs go offline. Second, it opens the door to hardware tampering, malicious code, or hidden “backdoors” inserted far from the prime contractor. In a conflict, such compromises could degrade systems at the worst possible moment.

From mapping to mitigation: what leaders should do next

Defense leaders cannot remove every risk, but they can change the odds. The first step is to map critical supply chains down to raw materials and sub-tier suppliers. You need to know who refines your rare earths, who packages your chips, and where they sit on the map.

The second step is diversification. Whenever possible, spread sourcing across multiple trusted suppliers and geographies. Ally-shoring matters here. Working with reliable partners on mining, refining, and fabrication reduces exposure to single-country chokepoints.

The third step is to build buffers where substitution is hard. Strategic stockpiles of critical minerals and key components can buy time in a crisis. Meanwhile, targeted investment in secure semiconductor manufacturing for defense-grade chips can protect priority programs, even if the global market comes under stress.

Finally, embed supply chain intelligence into operational planning. Tabletop exercises and wargames should test how long you can sustain high-intensity operations when specific nodes in the industrial base fail. This reveals hidden dependencies long before they become real-world constraints.

Key takeaway for defense decision-makers

Future conflicts will not be decided by platforms alone. They will also turn on how long each side can sustain precision fires, keep ISR networks alive, and repair complex systems under pressure. In that race, defense supply chain vulnerabilities are a silent but decisive factor.

Defense ministries, prime contractors, and strategic suppliers that act now will build a real advantage. Those that delay will discover that the true “off switch” for their capabilities may sit in a distant refinery or semiconductor plant they do not control.

For a broader perspective on industrial resilience and national power, see our related insight on defence industrial base resilience.

For further background on critical materials and microelectronics risk, explore official resources from NATO and the U.S. Government Accountability Office.