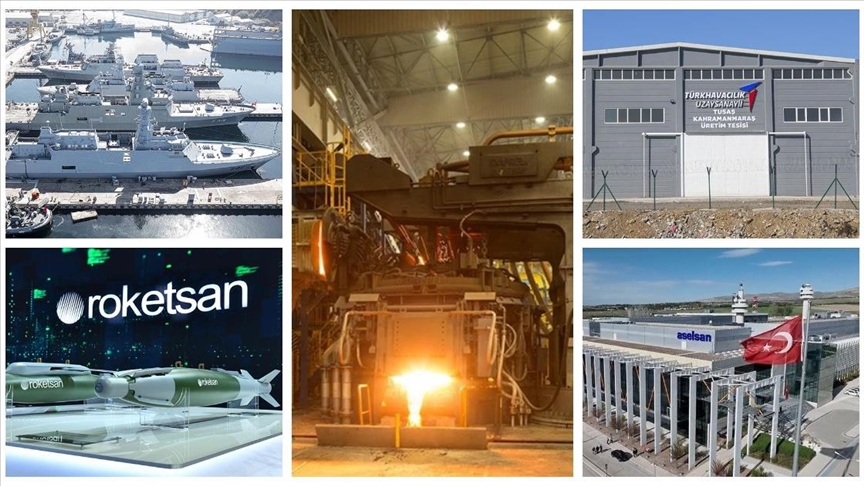

Defense News Top 100 Turkish companies continue to consolidate their positions in the global league table, with ASELSAN (43), TUSAŞ (47), Roketsan (71), ASFAT (78) and MKE (80) all appearing in the 2025 ranking. This year’s list, compiled by Defense News on prior-year defence revenues, shows Turkish primes sustaining momentum amid Europe’s rearmament cycle and expanding export portfolios. Crucially, all five are SAHA Istanbul member firms—underscoring the cluster’s role as a force multiplier for Türkiye’s Milli Teknoloji Hamlesi.

Key Facts

• Rankings: ASELSAN 43; TUSAŞ 47; Roketsan 71; ASFAT 78; MKE 80. [1][2]

• Top 10 composition: Six U.S., two Chinese, one British and one French company. [1]

• Each Turkish company listed is a confirmed SAHA Istanbul member firm. [3][4][5][6][7]

Why this ranking matters

These results help readers see where Türkiye stands in the global supply chain. Moreover, they point to real capacity to deliver: export backlogs, system integration skills and after-sales support. As a result, partners looking for affordable, interoperable systems can assess risk and schedule with more confidence.

Cluster power: SAHA Istanbul’s imprint on the table

In practice, behind the headlines lies a structural story: all five Defense News Top 100 Turkish companies share the same industrial home base—SAHA Istanbul, Europe’s second-largest defence and aerospace cluster. The cluster aggregates prime contractors and deep supplier benches under common quality systems, committees (e.g., MIHENK) and B2B acceleration platforms, producing scale effects in testing, certification and international outreach. [8][9][10][11]

“SAHA Istanbul is the most committed supporter of Türkiye’s Milli Teknoloji Hamlesi—turning R&D into deployable, exportable capability through coordinated industrial depth.”

This year’s composition highlights how that depth manifests: radar and C4ISR (ASELSAN), airframes and composites (TUSAŞ), precision strike ecosystems (Roketsan), heavy MRO and naval programs (ASFAT), and energetics–munitions (MKE). The cluster’s shared supplier networks compress lead times for integration, qualification and export after-sales, which in turn sustains ranking resilience even as exchange rates, input costs and geopolitics fluctuate.

Company snapshots: capabilities at a glance

Within the Defense News Top 100 Turkish companies cohort, each prime anchors a clear capability lane while benefiting from SAHA Istanbul’s shared depth.

ASELSAN — C4ISR, sensors, electronic warfare and secure communications. It often acts as the systems integrator for layered air defence and joint fires networks.

TUSAŞ (Turkish Aerospace) — Fixed- and rotary-wing platforms plus UAV/UCAV airframes and advanced composites. Digital engineering and MRO help accelerate upgrades and series production.

Roketsan — Precision-strike families spanning guided rockets, anti-armour missiles and coastal defence effectors. Modular seekers and datalinks ease cross-domain integration.

ASFAT — Military factories and shipyards for heavy depot maintenance, platform modernization and surface combatants. Turnkey sustainment and lifecycle packages support exports.

MKE — Energetics, ammunition and land systems across small-, medium- and large-calibre lines. Expanding propellants and precision artillery tighten the munitions-industrial loop.

Together, these roles reduce integration risk and shorten delivery timelines.

Ranking dynamics and revenue context

At the global level, the 2025 table again places Lockheed Martin first, followed by RTX and China’s CASIC; Northrop Grumman and General Dynamics round out the top five, with BAE Systems sixth. Boeing, CSSC, L3Harris and Thales complete the top ten—an axis that mirrors current procurement priorities: missiles, munitions, C2 and maritime tonnage. [1][2]

Meanwhile, for Türkiye, the distribution across five primes reflects a balanced capability stack from sensors to shooters and sustainment. While headline rankings shift year-to-year—ASELSAN slipping one place; TUSAŞ climbing; Roketsan holding; ASFAT and MKE advancing—the aggregate presence indicates staying power. This aligns with recent export data, where Turkish defence sales reached record levels in 2024 on the back of unmanned systems, smart munitions, and shipbuilding packages. [12]

What the rankings signal for procurement and exports

Moreover, procurement planners read the Defense News Top 100 Turkish companies as a proxy for delivery capacity and financial endurance. Multi-year orderbooks in C4ISR, UCAVs, air defenders, guided rockets and heavy platforms are likely to underpin 2026–2028 cashflows. For allies, Turkish primes now offer full-spectrum packages (platform + effectors + C2 + training), which shortens capability insertion timelines.

Likewise, for the suppliers orbiting these primes, SAHA Istanbul’s committees standardize quality (AS/EN 9100, AQAP), while the cluster’s international programs (DSEI, MSPO and similar) lower market-entry friction. This is not simply a marketing layer; it is a governance framework that ensures documentation, traceability and customer support can scale with orders. [8][13]

Strategic outlook: where the cluster goes next

Three vectors stand out:

1) Systems integration as a differentiator. Turkish primes increasingly win on systems engineering—tying sensors, effectors and data links into tailored kill chains. Expect more turnkey air defense, coastal security and OPV packages, combining ASELSAN sensors, Roketsan effectors, TUSAŞ platforms and ASFAT shipyard capacity.

2) Industrial sovereignty and allied interoperability. The same companies are embedding NATO STANAG compliance while retaining domestic IP control. This duality opens doors in Europe, the Gulf and Indo-Pacific, where buyers seek non-ITAR options that still interoperate with Alliance systems.

3) Workforce and test infrastructure. Ranking durability depends on people and labs. SAHA Istanbul’s ecosystem—universities, test & certification bodies and SMEs—remains central to training, qualification and fast iteration, reinforcing Türkiye’s move up the value chain.

Internal link — SAHA 2026 platform effect

For a deeper dive on how trade-show diplomacy and B2B orchestration expand orderbooks, see our coverage of SAHA 2026 returns to Istanbul and its role in accelerating cluster-wide export pipelines.

Conclusion

Ultimately, the 2025 table does more than celebrate five logos. It validates a decade of capability building—and the power of clustering. With Defense News Top 100 Turkish companies all anchored in SAHA Istanbul, Türkiye’s defence industry is not only present in the rankings; it is building the institutional machinery to keep climbing.

References

- Anadolu Ajansı report on the 2025 ranking and positions. Link

- Defense News — Top 100 (2025). Link

- SAHA Istanbul member page — ASELSAN. Link

- SAHA Istanbul member page — TUSAŞ (Turkish Aerospace). Link

- SAHA Istanbul member page — Roketsan. Link

- SAHA Istanbul member page — ASFAT. Link

- SAHA Istanbul member page — MKE. Link

- SAHA Istanbul — Europe’s 2nd-largest cluster (DSEI note). Link

- SAHA Istanbul — MIHENK / quality ecosystem pages. Link

- SAHA Istanbul — Who we are / governance. Link

- SAHA Istanbul — International programs & MSPO example. Link

- Defense News — Türkiye’s 2024 export record context. Link