As navies build a hybrid fleet—pairing crewed ships with uncrewed surface vessels (USVs)—USV technology is moving from demo to duty. It cuts cost, speeds refresh, and lowers risk at sea. Recently, L3Harris, Metal Shark, and Red Cat’s Blue Ops announced steps that, together, show how fast the market is maturing.

Key Facts

- Date: 27 October 2025

- Theme: Uncrewed surface vessels (USVs) enabling a hybrid fleet concept

- Notable updates: L3Harris adds a maritime VAMPIRE C‑UAS variant; Metal Shark unveils a high‑speed USV and autonomy partnerships; Red Cat launches Blue Ops to mass USV development

- Why it matters: Cheaper, modular USVs can expand fleet presence, protect high‑value units and accelerate iteration cycles compared with crewed combatants

- Operational focus: Counter‑UAS defence, maritime domain awareness, strike/escort, and mothership‑USV teaming

Context and the New Development

Western planners want more hulls in the water, yet not the full cost or timeline of a frigate. Therefore, modular and attritable USVs with AI assistance are drawing funds. In late 2025, three signals stood out. First, L3Harris introduced navalised VAMPIRE C‑UAS variants. Second, Metal Shark detailed high‑speed unmanned craft and autonomy tie‑ups. Third, Red Cat expanded from air to sea with its Blue Ops division to design and scale USV families.

Technical and Operational Effects

Counter‑UAS at sea. Task groups face low‑cost one‑way drones and quadcopters, especially in the littorals. A maritime VAMPIRE adds truck‑mount simplicity to small patrol craft and auxiliaries. It pairs stabilised sensors with tube‑launched interceptors. As a result, it improves cost per shot and saves high‑end SAMs for peer threats. In layered defence, it complements soft‑kill EW and guns.

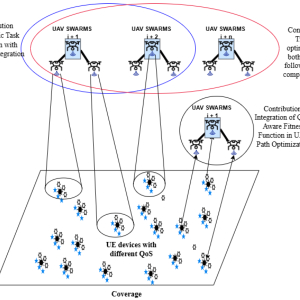

Speed, manoeuvre and payload modularity. Metal Shark’s latest high‑speed USVs keep a human‑in‑the‑loop, with autonomy as an assist. They support interception, escort, and quick picket moves. A common hull plus mission kits—ISR masts, counter‑UAS tubes, loitering munitions, and decoys—reduces integration risk. It also enables spiral upgrades.

From air to sea—portfolio convergence. By standing up Blue Ops, Red Cat ports drone‑war lessons to the sea. Sensors, autonomy stacks, and attritable design carry across. Consequently, expect tight links between USVs, kinetic/EO payloads, and a common C2 layer. This supports manned–unmanned teaming and distributed maritime operations.

Programme and Procurement Lens

Acquisition teams can shorten lead times by using commercial yards and COTS electronics. They can also run fleet experiments. Buy small lots, deploy to numbered fleets, and then iterate software and payloads from operator feedback. In this model, capital ships and frigates act as motherships. USVs push sensors, decoys, and shooters outward, thus increasing the task group’s effective radius with no added crew risk.

Budget owners will track through‑life costs: autonomy sustainment, sensor obsolescence, secure links, and maritime hardening (salt‑spray, shock, EMC). Even so, the value case—more presence per dollar—remains strong in contested seas and a stretched industrial base.

Risks, Alternatives and Counter‑Arguments

- C2 and spectrum: SATCOM and LOS links are vulnerable in a contested EM environment. Therefore, resilient autonomy and on‑board decision logic must cover comms‑denied cases.

- Rules of engagement: Kinetic autonomy requires strict human‑on‑the‑loop controls and clear ROE. Hence, navies will phase in graduated autonomy starting with ISR and decoy roles.

- Survivability: Small USVs are visible and fragile. Thus, doctrine will stress numbers, dispersion, and deception over single‑platform toughness.

- Integration debt: Legacy CMS and logistics must absorb new attritable classes. Open architectures and common control standards will decide winners.

Implications / Next

In the near term, trials will focus on C‑UAS pickets, harbour and strait security, and escort swarms. Meanwhile, mothership–USV concepts will mature in parallel. Expect procurement pilots that use regional shipyards for hull scale and software‑defined payloads for rapid role change. For industry, the brief is simple: ship clean interfaces, export‑ready variants, and evidence from sea trials—not slideware.

Further Reading

- How AI and robotics drive innovation in land‑based defence (Defence Agenda)

- Viper Shield pod: L3Harris’ next‑gen EW for tactical aircraft (Defence Agenda)

- L3Harris announces new naval VAMPIRE C‑UAS variants (Press Release)

- Red Cat launches Blue Ops maritime USV division (Press Release)