The U.S. Marine Corps is pushing ahead with MARNAV Block 2 resilient PNT vendor demonstrations aimed at fielding M‑Code, NAVWAR‑ready, drop‑in replacements for legacy DAGR‑class receivers across combat platforms. Though the notices have drawn little mainstream coverage, the move matters: it signals a pivot to cheaper, faster, vehicle‑edge Assured PNT that can be bought at scale and integrated with Army MAPS baselines. For programme offices and suppliers, Block 2 choices will shape platform wiring, antenna fits, and evidence for NAVWAR compliance over the next two budget cycles.

Key Facts

What’s new: USMC issued MARNAV Block 2 vendor demo notices seeking direct, drop‑in, M‑Code‑capable replacements for DAGR‑class receivers and associated enablers. [3][4]

Timing: Special notice and RFI activity centred on Q1–Q2 FY2025; vendor demos were planned through May 2025, informing a full‑and‑open competition. [3][6]

Scope: Block 2 aims to satisfy NAVWAR compliance across vehicle platforms and C4ISR/EW nodes, complementing Army MAPS GEN II. [5][7]

Why it matters: A lower‑cost, drop‑in path could accelerate resilient PNT fielding versus full MAPS retrofits where budgets are tight.

Conflicting identifiers: Notices cite different numbers (M67854‑24‑I‑2040 and M67854‑25‑I‑2008), but both reference MARNAV Block 2 intent. [3][4][6]

Context and the new development

MARNAV (Mounted Assured Resilient Navigation) is the Marine Corps’ vehicle‑centric PNT modernisation effort. Earlier policy set the tone: platforms producing or consuming PNT data must be NAVWAR compliant, with a preference for M‑Code. [8][10] In 2024–2025 the Corps signalled Block 2 to cover the bulk of combat platforms and nodes, publishing RFI and vendor demonstration calls that emphasised M‑Code and “additional PNT enablers/alternatives” as drop‑in solutions. [3][4][5][6]

Parallel Army work provides the practical baseline. PM PNT has delivered MAPS GEN II and DAPS GEN II in quantity, illustrating the kind of edge architectures Marines intend to leverage or mirror where sensible. [7] For USMC, Block 1 needs are largely satisfied via MAPS Gen II buys; Block 2 shifts the centre of gravity to cost‑effective, form‑fit‑function upgrades and antenna kits that scale fast across the fleet. [5]

Technical and operational implications

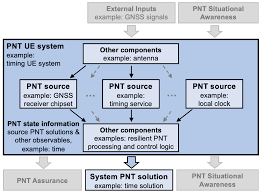

Drop‑in M‑Code receivers, plus enablers. The demo focus on direct replacements cuts cabling changes and speeds installs. However, resilience still depends on antenna performance, anti‑jam/beamforming, and sensor fusion (e.g., IMU, odometry, alt‑nav aids). Expect evaluation to weigh holdover stability, spoofing detection, and timing quality for C4ISR loads. [3][4]

NAVWAR verification and evidence. USMC policy requires NAVWAR certification across producers/consumers of PNT. Programmes will need clear test artefacts—likely leveraging Army test data where interfaces align—and must document contested‑environment performance within defined threat profiles. [8][10]

Interoperability with MAPS GEN II. Even where Marines choose drop‑ins, data compatibility with MAPS‑style distribution and platform mission systems remains a gating factor. The easier the receiver integrates with existing vehicle data busses and client apps, the faster fielding goes. [7]

Lifecycle and upgrade cadence. A commercial‑derivative receiver path allows faster refresh, but demands clear crypto/firmware update pipelines and airworthiness/safety evidence for certain platforms. That favours modular designs that can absorb future signals and alt‑nav modes.

Programme and procurement angle

Slides shared with industry show full‑and‑open competition for Block 2, mixing FFP hardware CLINs with CPFF engineering support—typical where integration and test need flexibility. [5] Long‑range acquisition tables reinforce the 2025 demo window and note down‑select after system‑level testing. [6]

For vendors, capture strategy should highlight: form‑fit‑function parity with DAGR‑class footprints; proven M‑Code performance with anti‑jam antenna options; evidence of NAVWAR compliance paths; and integration artefacts that align with MAPS GEN II client expectations. For government teams, the drop‑in approach supports fleet‑wide scaling under constrained accounts while preserving a pivot to MAPS‑like backbones where needed.

Risks and alternatives

Risk: “drop‑in” ≠ drop‑out risk. Without careful antenna siting and platform‑specific test, even perfect receivers underperform. Mitigation: installation SOPs, platform‑level survey, and validated beamforming kits.

Risk: crypto/logistics churn. M‑Code crypto updates and key management can stress units. Mitigation: early key‑fill workflow trials and training with representative loads.

Alternative path: where full MAPS retrofits are already planned or funded, Block 2 installs should prioritise interface compatibility and data distribution rather than running two parallel stacks.

Implications / Next

Expect USMC to refine requirements and move toward down‑select post‑demo, with a competition construct that enables scale buys from FY2026. Industry should prepare NAVWAR evidence packages, antenna site‑surveys, and integration notes mapped to MAPS‑style data clients. For broader context on industrial base and space‑domain dependencies that underpin resilient PNT, see Defence Agenda’s previous coverage. [1][2]

References

[3] SAM.gov: MARNAV Block 2 Vendor Demonstrations (notice)

[4] SAM.gov: MARNAV Block 2 Vendor Demonstrations (alt ref)

[5] USMC PM TCE Opportunities (MDM slides)

[6] MCSC Long‑Range Acquisition Estimates (June 2025)

[7] PEO IEW&S: Assured PNT partnerships (MAPS/DAPS)

[8] USMC MARADMIN: PNT & GPS policy (M‑Code)