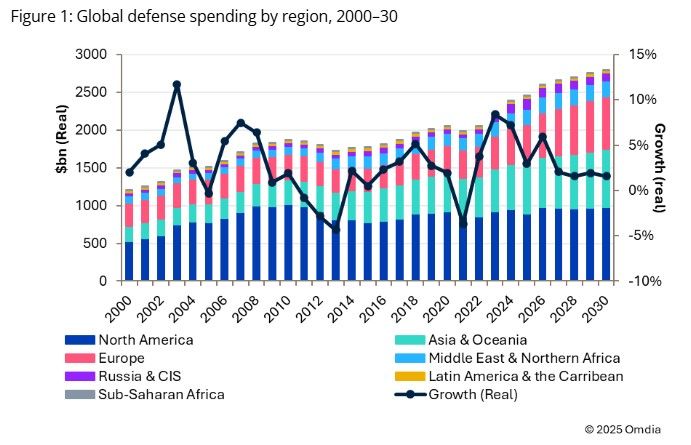

A new global defence spending forecast 2026 estimate from Forecast International projects worldwide top-line military outlays will reach $2.6 trillion by the end of 2026, up from $2.4 trillion in 2025. The firm also expects the trajectory to continue toward $2.9 trillion by the end of the decade, underscoring how modernisation, munitions replenishment, and air-and-missile defence priorities are reshaping procurement plans across most major regions.

For ongoing coverage, see our defence spending tracker and analysis on the defence industrial base.

Key Facts

- 29 January 2026: Forecast International analysts brief the market in a webinar.

- Forecast International projects $2.6 trillion in global defence spending by end-2026.

- The firm estimates $2.4 trillion for 2025, implying an 8.1% year-on-year rise.

- North America delivered the largest five-year increase in absolute terms, with growth driven primarily by the United States.

- Europe and “Eurasia” (as defined by the firm) show comparable growth dynamics due to the Ukraine war.

- Missile defence and layered air defence requirements are expanding across Europe, the Middle East, and the Indo-Pacific.

What Forecast International is measuring

Forecast International’s analysts emphasised that their series aims to remove “grey areas” where possible. In practice, that means they attempt to focus on defence outlays tied to warfighting capability rather than wider public-security categories such as internal security forces and some veteran pension costs.

That methodological choice matters. It can produce lower top-line figures than other public estimates, especially for countries where security forces, paramilitary spending, and post-service benefits are material shares of the broader national security budget.

Global defence spending forecast 2026: the drivers behind the rise

Forecast International’s briefing highlighted a combination of demand-side and supply-side dynamics.

1) The United States remains the primary growth engine

The United States remains the world’s largest spender on military capability, and it continues to set the tempo for global procurement. In the webinar, the firm’s analysts argued that rising US investment has become a major contributor to the global uptrend.

A major takeaway for industry is not only the size of the US topline, but the policy direction behind it: modernisation, industrial base expansion, and increased inventory depth in high-consumption categories.

2) Europe’s spending surge is now structural

Europe’s post-2022 spending growth increasingly looks structural rather than cyclical. The operational lesson-set from Ukraine has reinforced priorities such as:

- munitions stockpiles and surge capacity

- integrated air and missile defence (IAMD)

- unmanned systems and counter-UAS measures

- resilience, logistics, and sustainment

In addition, debates around higher defence spending targets—alongside “security-related” spending categories—highlight how political definitions may influence headline compliance while still leaving capability outcomes dependent on how budgets are allocated.

3) “Eurasia” growth reflects wartime expenditure and adaptation

Forecast International groups Russia and Ukraine under a regional “Eurasia” label. In the webinar materials, analysts associated the region’s growth profile with the war’s industrial and operational realities.

The implication is clear: sustained high-intensity conflict drives fast procurement cycles, increased maintenance and repair throughput, and accelerated learning loops for drones, electronic warfare, and air defence.

4) Missile defence and layered air defence are becoming universal requirements

The analysts also framed missile defence and layered air defence as a “universal requirement”. Many armed forces now prioritise networks rather than single platforms.

They pointed to multiple regional examples:

- Europe: the European Sky Shield Initiative (ESSI)

- Türkiye: the “Steel Dome” concept

- Greece: the “Achilles Shield” concept

- Indo-Pacific: Taiwan’s interest in additional indigenous and imported capabilities

For more on this theme, see our air and missile defence coverage.

The US “Golden Dome” debate: capability ambition versus cost realism

Forecast International analysts also discussed proposals for large-scale US missile defence architecture, including the “Golden Dome” concept. While figures circulate publicly, the core issue is not the number itself. The key question is what capability baseline it buys.

A “baseline” missile defence layer, for example, differs materially from a fully mature nationwide network. The latter would likely require:

- persistent sensors (ground, sea, air, and space)

- battle management and command-and-control integration

- interceptor depth across multiple layers

- resilient communications and cyber hardening

As a result, cost scales with ambition—and programme risk often concentrates in integration, sustainment, and industrial capacity rather than in any single platform.

Regional snapshots: where budgets are expanding fastest

North America

North America delivered the largest absolute growth over the past five years in Forecast International’s series, driven overwhelmingly by US spending. Industrially, that has translated into renewed emphasis on production scale, supply-chain security, and workforce constraints.

Europe

Europe’s growth now touches nearly every portfolio: long-range fires, ground-based air defence, ISR, munitions, and naval recapitalisation. Moreover, European demand increasingly emphasises availability and quantity, not only exquisite performance.

Middle East

The analysts noted that oil revenue enables high-end acquisition in many Middle Eastern markets, particularly in air power and air defence. However, they also warned that falling oil prices could constrain future toplines.

Asia-Pacific

China’s declared defence budget and broader expenditure estimates remain a major forcing function for Indo-Pacific planning. The webinar discussion argued that China’s military build-up drives counter-investment by potential adversaries and partners.

Top 10 defence spenders in 2025 (Forecast International)

What the numbers mean for industry

A rising topline does not automatically translate into usable combat power. Forecast International’s analysts stressed that capability outcomes depend on allocation, execution, and industrial throughput.

Three implications stand out:

- Production capacity becomes a strategic variable. Many procurement plans now treat throughput, lead times, and component sourcing as operational risk factors.

- Integrated air defence is moving from niche to baseline. Countries increasingly expect layered networks, driving demand for sensors, C2, interceptors, counter-UAS, and EW integration.

- Budget politics can distort capability delivery. Headline spending targets can encourage accounting solutions. However, readiness improves only when spend delivers deployable capacity and sustainable inventories.

Implications and what to watch next

The global defence spending forecast 2026 outlook reinforces a simple reality: most regions now plan for a more contested security environment, and they are funding capability pathways accordingly.

The next proof points will be concrete:

- which countries convert toplines into delivery of munitions and IAMD capacity

- how quickly the US and Europe expand defence industrial output

- whether Middle East spending holds under oil-price pressure

- how Indo-Pacific states respond to China’s sustained modernisation

Further Reading

- Defence spending

- Defence industrial base

- Air and missile defence

- Indo-Pacific security

- Forecast International

{

"@context": "https://schema.org",

"@type": "NewsArticle",

"headline": "Global defence spending forecast 2026: $2.6tn outlook",

"description": "Global defence spending forecast 2026: Forecast International projects $2.6tn by end-2026, driven by US growth, Europe’s surge, and missile-defence demand.",

"inLanguage": "en",

"datePublished": "2026-02-01",

"dateModified": "2026-02-01",

"author": {

"@type": "Person",

"name": "Muzaffer Ünsaldı"

},

"editor": {

"@type": "Person",

"name": "Muzaffer Ünsaldı"

},

"articleSection": "Defence Spending",

"isAccessibleForFree": true,

"mainEntityOfPage": {

"@type": "WebPage",

"@id": "https://defenceagenda.com/global-defence-spending-forecast-2026-26-trillion/"

},

"image": [

{

"@type": "ImageObject",

"url": "https://defenceagenda.com/wp-content/uploads/2026/02/global-defence-spending-forecast-2026-lead.jpg",

"width": 1600,

"height": 900

},

{

"@type": "ImageObject",

"url": "https://defenceagenda.com/wp-content/uploads/2026/02/global-defence-spending-forecast-2026-chart.jpg",

"width": 1200,

"height": 675

}

]

}