MKE anti-drone systems took center stage at DSEI, where Makine ve Kimya Endüstrisi (MKE) detailed a sweeping agenda: international co‑production deals, a multi‑site explosives capacity build‑out worth roughly $818 million, and a strategic pivot from legacy munitions to smart effects and autonomous platforms. Speaking in London, General Manager İlhami Keleş framed the moment succinctly: Türkiye’s flagship manufacturer is transitioning from a conventional supplier into a technology partner for allies, with demo events and export‑ready counter‑UAS capabilities to match [1][2][3].

Key Facts

Focus: MKE anti-drone systems, explosives industrial base, and smart munitions roadmap.

International footprint: Negotiations reportedly ongoing with 11 countries for ammunition production lines [1].

Industrial sovereignty: ~$818M investment program including a new explosives complex on a 4.7 million m² site; new facilities in Samsun, Kırşehir and Elmadağ [1].

Near‑term milestone: Counter‑UAS demonstration at Karapınar with foreign delegations this month [1].

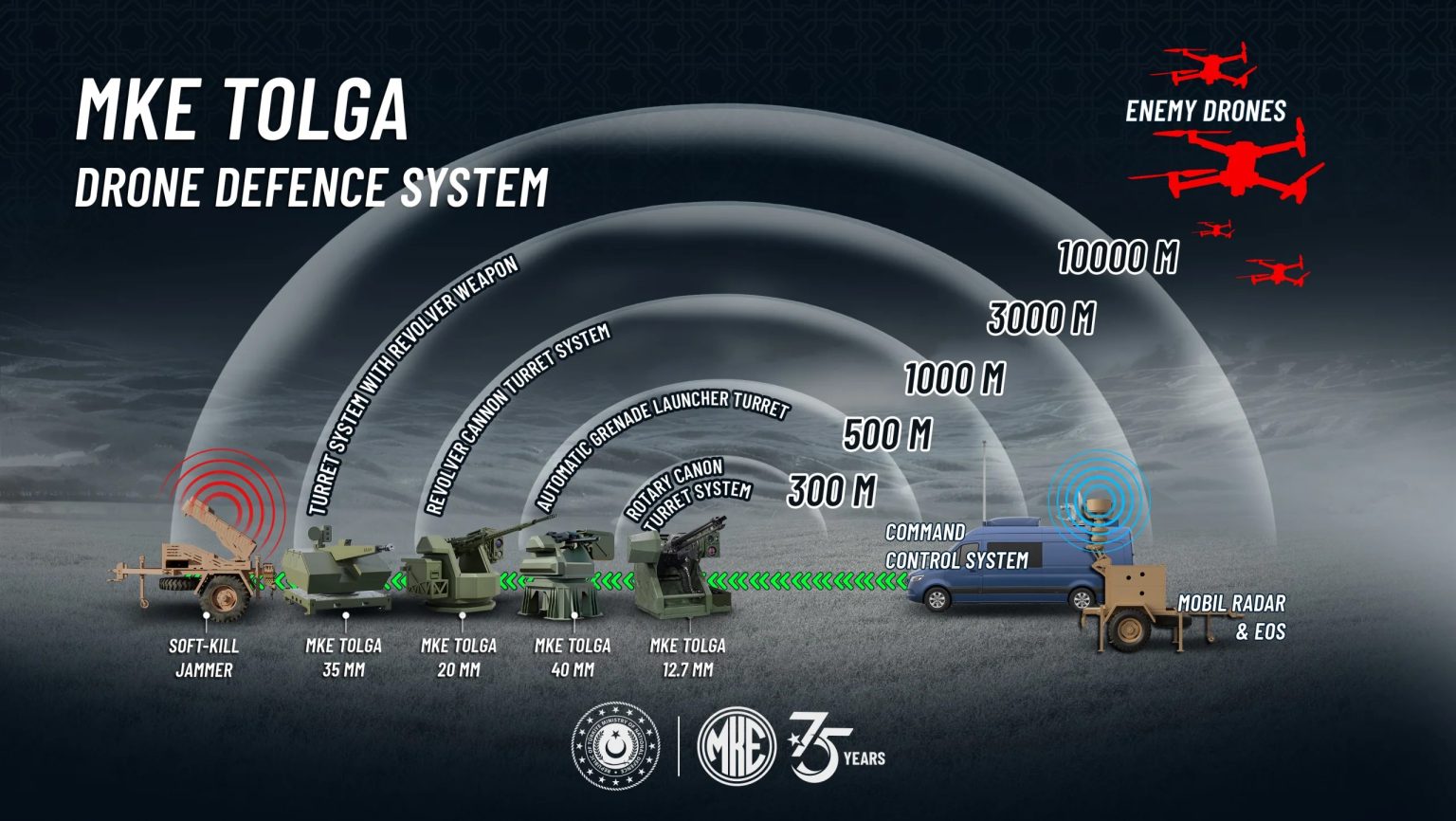

Product vector: From classic ammunition to smart effectors and unmanned systems—e.g., Tolga counter‑drone solutions, loitering USVs, intelligent mine concepts [1][4].

From industrial autonomy to battlefield relevance

DSEI is a proving ground for vendors that can turn operational lessons into producible, interoperable solutions. In that context, MKE anti-drone systems signal a deliberate shift: the company is targeting the cost‑exchange dilemma militaries face when cheap drones force expensive interceptors, by fielding layered effectors and jamming options sized for base protection, convoy overwatch, and mobile formations [2][4]. This aligns with a broader Turkish drive to harden strategic autonomy in energetics and to export turnkey production capacity to trusted partners.

Keleş underlined that MKE’s role is evolving beyond a catalogue supplier. The ongoing talks for establishing ammunition lines in 11 countries suggest a co‑production approach that embeds MKE’s process know‑how and quality systems in allied ecosystems [1]. If executed rigorously, such deals can lower logistics risk, speed replenishment cycles, and create shared configuration control across user communities—an advantage that matters when drone and counter‑drone spirals compress decision timelines.

Explosives capacity: the spine of effectors

Effectiveness in counter‑UAS and precision effects ultimately rests on energetic materials. MKE’s announcement of a 4.7 million m² explosives complex—and new plants across Samsun, Kırşehir, and Elmadağ—directly targets this bottleneck [1]. By internalising energetic precursor production and scaling filling/finishing lines, the company can stabilise costs and shorten lead times for MKE anti-drone systems and smart munitions families alike.

Strategically, this is about assured supply. Türkiye’s push to localise propellants, warhead fills, and fuzing supports surge output without exposing critical chains to external shocks. It also enables rapid iteration—warhead liners, fragmentation patterns, and directed‑energy absorber materials can be A/B tested against evolving UAV signatures and swarm tactics.

Counter‑UAS roadmap: Tolga and beyond

Within the counter‑UAS portfolio, the Tolga family has drawn attention for combining detection, electronic attack, and kinetic options in configurable packages. Reporting indicates engagement envelopes tailored from inner‑layer base defence to forward units, with demos slated at Karapınar for international observers [1][4]. The objective is to prove repeatable effects across drone classes (Group‑1 to low Group‑3), in cluttered RF environments, and under GPS‑denied conditions—where many commercial drones still exploit consumer RF bands and line‑of‑sight control links [4].

To be credible at scale, MKE anti-drone systems must integrate into joint kill‑chains: cueing from passive RF and radar, handover to jammers or directed kinetic layers, and battle‑damage assessment feeds to command apps. This implies open interfaces, cyber‑hardening, and mission‑data reprogramming cycles measured in days, not months. DSEI provides the right venue to socialise those requirements with NATO operators and primes [2][3].

From munitions maker to technology partner

Keleş’s framing—“we must add intelligence to explosives”—captures the inflection point. Smart fuzes with adaptive height‑of‑burst, proximity logic tuned for small cross‑sections, and EW‑resilient guidance are now baseline features, not luxuries. For MKE, the transition means higher mix/medium volume manufacturing, modular electronics in harsh environments, and software pipelines that meet defence‑grade DevSecOps standards.

The pivot also opens new export vectors. Co‑developed intelligent mines with self‑neutralisation timers, or expendable kamikaze USVs for harbour denial, all sit upstream of energetic supply. As such, the explosives mega‑site is not a standalone bet; it is the enabling layer for MKE anti-drone systems and future effectors that demand consistent energetic performance and precise lethality curves.

Why it matters for Türkiye’s defence economy

Industrial sovereignty in energetics is one of the hardest problems for middle powers. Success would reverberate across Türkiye’s clustered ecosystem—including platform integrators, guidance/EO houses, and testing ranges—compressing cycle times from concept to qualified product. Within that network, organisations such as SAHA Istanbul convene hundreds of firms and universities to absorb and amplify such capability gains through supplier development and joint R&D. The end‑state is straightforward: reliable supply, competitive cost, and export‑grade quality built into MKE anti-drone systems and smart munitions.

For operators, the metric is simpler: cost per defended asset. If MKE can show at Karapınar that its layered counter‑UAS kits deliver acceptable effects at sustainable cost against diverse threat sets, procurement pathways open—particularly for nations seeking sovereign sustainment rather than perpetual import dependence.

“It is not enough to produce ammunition; without investing in technology we cannot exist tomorrow. We must add intelligence to explosives.” — İlhami Keleş

What to watch next

Three signals will indicate whether momentum translates into programmes of record. First, the Karapınar demos: repeatable, instrumented results across UAV classes in mixed clutter will validate claims. Second, anchor co‑production deals: at least one ammunition line abroad that meets NATO AQAP/AS9100 baselines would prove the model. Third, energetics qualification: certifying the new plants and achieving statistical process control on critical fills will determine whether MKE anti-drone systems scale without performance drift.

Across all three, DSEI remains a convening node for requirement owners, primes, and SMEs. It is where roadmaps become MOUs and MOUs translate into funded pilots. In that sense, MKE’s message at DSEI is ultimately about time: compressing it in production, in reprogramming, and in the intercept window against fast‑evolving, low‑cost threats.

Related: Our DSEI field coverage and day‑by‑day round‑ups are here [1].

See DSEI’s official visitor brief and exhibitor guidance for context on how capabilities are evaluated on the floor [2][3]. For Tolga’s counter‑UAS profile, see field reporting and official statements [4].

Further Reading

- Defence Agenda — DSEI 2025 Post‑Show

- DSEI UK — Why Visit DSEI

- DSEI UK — Exhibit at DSEI

- MKE — Official Website

- Anadolu Ajansı — MKE introduces Tolga counter‑drone system

- GDH Digital — Source report

References

- Source interview/reporting: GDH Digital, “MKE’den DSEI’de stratejik hamleler…” (11 Sept 2025). Link above.

- DSEI UK — Why Visit DSEI. Link above.

- DSEI UK — Exhibit at DSEI. Link above.

- Anadolu Ajansı — “MKE introduces Tolga counter‑drone system.” Link above.