“`html

Indo-Pacific unmanned systems: Red Cat on autonomy

Indo-Pacific unmanned systems are moving from an “add-on” capability to a core force-design tool. Across the region, militaries want drone fleets that can support reconnaissance, contested logistics, strike missions, and point defence. In a Breaking Defense sponsored interview, Red Cat’s Asia-Pacific business development director Stayne Hoff said the key advantage will come from fast upgrade cycles, modular integration of autonomy, and resilience when communications and navigation degrade.

Disclosure: This report is based on a sponsored interview published by Breaking Defense and provided by the user in full text form. Direct claims and quotations are attributed to the interviewee.

Key Facts

- Focus: Indo-Pacific drone demand is expanding beyond ISR into logistics, strike, and defensive roles.

- Design priority: Manufacturers must refresh designs quickly to keep pace with rapidly evolving countermeasures.

- Autonomy bar: Operators now expect autonomy that works predictably and safely in denied or contested environments.

- Industrial model: Red Cat emphasises partner integration—adding third-party autonomy or payloads when customers request it.

- Market structure: Hoff described three “winner” archetypes: fast platform firms, AI-centric venture-backed players, and consolidators that assemble families of unmanned systems.

- Supply-chain logic: Keeping two or three suppliers for key subsystems helps manage both technical risk and price risk.

Why Indo-Pacific unmanned systems are not simply “Ukraine, but with islands”

At first glance, the capability set looks familiar. Forces want first-person view (FPV) strike drones, intelligence-surveillance-reconnaissance (ISR), and small logistics drones that move supplies without risking crews. However, the Indo-Pacific changes the engineering and sustainment problem.

First, maritime distances push range and endurance. Second, forward sites are limited and easier to target. Third, electronic warfare and spoofing pressure can rise because spectrum is crowded and the cost of a mistake is high. As a result, many programmes now value resilience and fleet sustainability as much as raw airframe performance.

Hoff used Ukraine to illustrate what high-tempo iteration looks like. He characterised Ukraine’s domestic output as “something like 300,000” drones per month. Treat that as an interview claim, not a verified metric. Even so, the underlying lesson is clear: attritable systems create operational leverage when production scale and learning speed are high.

For Taiwan-focused scenarios, Hoff argued the industrial constraint becomes decisive. If a blockade disrupts parts flow, then the “where” of manufacturing matters as much as the “what” of capability. Therefore, Indo-Pacific unmanned systems often need designs that tolerate substitute components and field repairs under disruption.

From platforms to systems: teaming and kill-web coherence

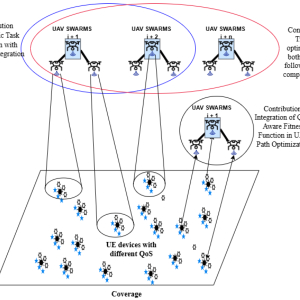

Hoff framed the operational challenge as more than buying drones. Instead, he emphasised pairing attritable platforms with the right ISR and collaborative tactics so drones can operate as a “Wolf Pack” hunter-killer team.

This is a system behaviour problem. One element finds and fixes a target. Another prosecutes. Meanwhile, other assets relay data, deceive sensors, or harden the network. In practice, that turns into a kill-web requirement: sensors, effectors, and command-and-control (C2) must stay coherent even when links degrade and operators spread out.

Consequently, buyers tend to push for open interfaces and modular payload integration. They also care about spectrum discipline and deconfliction, because friendly ISR drones, loitering munitions, and air-defence sensors can compete for the same bands. In short, Indo-Pacific fleets will win on repeatable integration and predictable behaviour under jamming.

Autonomy is everywhere—resilience is what matters

Autonomy now shows up across loitering munitions, small UAS, ground robots, and uncrewed surface warfare. Yet autonomy only helps if it holds up under pressure. Hoff stressed the need for autonomy that remains “reliable, deterministic, and effective” and that operates in denied environments with trusted resilience.

That focus creates concrete engineering questions for programme teams. For example, how much onboard compute keeps navigation stable when GPS is jammed? What redundancy keeps target tracking consistent when the data link drops? At the same time, what level of human-on-the-loop control is acceptable when bandwidth is scarce and collateral risk is high?

Hoff also highlighted a commercial reality that matters in the Indo-Pacific. Many customers want to bring their own autonomy stack and ask the platform vendor to integrate it. Therefore, suppliers need modular architectures and disciplined integration processes, so they can add a new “flavour” of autonomy without a full redesign.

Related topic: Autonomy and electronic warfare.

What differentiates newer firms from primes

Hoff argued that US procurement has started to place larger bets on younger companies where speed and iteration matter. In his view, three archetypes stand out.

First, smaller platform companies that move fast and avoid legacy hardware “drag.” Second, AI-centric, venture-funded defence firms. Third, “consolidators” that assemble families of unmanned systems into one solution set rather than selling a single widget.

For Indo-Pacific buyers, the takeaway is straightforward. Organisational agility and upgrade cadence can matter as much as scale. Moreover, integration maturity increasingly functions as a competitive moat.

Interoperability and the “two or three suppliers” strategy

On compatibility, Hoff described a pragmatic approach: keep multiple suppliers for key subsystems and avoid a single-point dependency. The logic is both technical and commercial.

The market leader may not deliver the best performance. Conversely, the best technology may price itself out of reach at scale. As a result, firms often carry two or even three options for emerging capabilities, then adjust as the market and the threat evolve.

For Indo-Pacific militaries, that maps to a clear demand signal: integration must be repeatable and fast, not bespoke and slow. Therefore, suppliers that can slot new payloads, radios, and autonomy modules into a standard architecture will usually outpace those that require long redesign cycles.

Industrial outlook: geography, blockade risk, and Australia’s ambition

Looking ahead, Hoff suggested geography will shape which supply chains lead. He noted Taiwan’s island geography creates obvious blockade and sustainment risk. Therefore, buyers may prefer supply lines that remain reachable under disruption.

By contrast, he described Australia as a country that wants to scale production capacity and attract US-aligned manufacturing investment across artillery, drones, loitering munitions, and missiles. Even if that ambition faces constraints, it points to the same lesson: the region will judge Indo-Pacific unmanned systems by how well they can be produced, sustained, and upgraded under stress.

Implications / Next

The interview reinforces a hard reality for Indo-Pacific planners: no technology advantage lasts for long. Instead, advantage comes from scalable systems engineering—how quickly fleets adapt under electronic attack, how safely autonomy performs under degraded links, and how resilient the industrial base remains under supply-chain shock.

In the near term, watch three indicators. First, national or regional certification regimes that reduce cyber and supply-chain risk for small UAS. Second, procurement language that rewards modular open architectures and fast refresh cycles. Third, co-production and sustainment deals that place repair and assembly capacity where it can survive disruption. Together, these choices will decide which concepts move from trials into enduring capability.

Further Reading

- Unmanned systems coverage on Defence Agenda.

- Loitering munitions and attritable systems analysis.

- Industrial base and supply-chain resilience reporting.

References

- Breaking Defense — Sponsored interview with Stayne Hoff (Red Cat), published 20 January 2026. (Add the original URL here:

PASTE_BREAKING_DEFENSE_URL_HERE.)

“`