Key Facts

• NATO’s June 2025 Innovation Challenge targeted fibre‑optic FPV threats; KMB Telematics won, with Sentradel second and Ukraine’s DONS third. [1]

• Russia’s fibre‑optic FPV drones bypass RF jamming and shaped the Kursk battlespace in 2025. [2][3]

• China’s reported “Storm Eye” seeks zonal protection from jamming via paired drones. [4][5]

• The USMC’s MQ‑9 now fields RDESS/SOAR—an EW pod able to mimic and confuse sensors. [6][7]

Why this matters now

The last three years transformed EW from a niche enabler into a decisive force‑design variable. RF‑denied skies over Ukraine incentivised low‑cost, “unjammable” attack profiles and cable‑tethered drones. NATO, in turn, is pushing open architectures and rapid integration pathways to out‑iterate fielded threats. As near‑peer competition tightens, the electronic warfare arms race moves toward speed of adaptation—shorter OODA loops in sensing, spoofing, and hard‑kill handoffs—rather than single exquisite systems.

From an industrial lens, this erodes the primacy of slow, linear procurement cycles. Solutions that scale quickly across platforms, ride commercial parts, and integrate with Alliance C2 will win. It is also a wake‑up call for primes: dominance will depend on orchestrating multi‑vendor sensor fusion, sovereign data pipelines, and software release velocity—not just metal.

Russia’s fibre‑optic FPV breakthrough

Ukrainian jamming forced Russian units to field fibre‑optic FPV drones in 2024–2025. These systems tether pilots to the munition via a thin fibre cable, trading range for absolute resilience against RF disruption. Reporting indicates they affected operations around Kursk and Sudzha, where Ukrainian formations faced precision strikes despite dense EW screens. [2][3]

Operationally, this inversion matters: when the uplink cannot be jammed, defenders must physically sever or defeat the munition. That shifts the engagement from EW to kinetic or mechanical defeat—nets, shotguns, cable cutters—or to targeting operators and spools. It also compels counter‑targeting: if the cable reveals bearing, can defenders trace it back under fire? Either way, the electronic warfare arms race now includes low‑tech constraints on an otherwise high‑tech fight.

Implications for NATO forces

NATO’s 16th Innovation Challenge explicitly framed this problem set. The winners showcase a playbook of cost‑effective radar/sensor nodes, AI fusion, and modular effectors that can be fielded fast and stitched into existing networks. KMB Telematics’ approach emphasises COTS, Sentradel offers a payload‑agnostic autonomous turret concept, while Ukraine’s DONS integrates ballistic computation with AI‑assisted thermal tracking for perimeter defence. [1]

For industry, the lesson is clear: proposals that compress time‑to‑integration and demonstrate NATO interoperability will outscore boutique hardware that cannot scale. This is where Alliance common standards—and sovereignty requirements—must converge.

China’s ‘Storm Eye’ and force re‑architecture

Beijing’s EW advances ride a broader organisational reform. In April 2024 the PLA dissolved the Strategic Support Force and stood up the Information Support Force (ISF), Cyberspace Force (CSF), and Aerospace Force (ASF), all under the Central Military Commission. The re‑architecture aims to centralise information dominance and accelerate “intelligentised” joint operations. [8][9]

Overlaying structure with concept, Chinese researchers have publicised a novel “Storm Eye” effect: two drones, one jamming and one transmitting a counter‑signal, create a protected zone where friendly emissions are shielded from disruption while adversary links degrade. If validated, this would localise EW effects and reduce blue‑on‑blue interference—a long‑standing weakness of brute‑force jamming. [4][5]

On platforms, the Fujian carrier’s catapults and the emerging J‑15DT/J‑15D electronic attack line signal the PLAN’s ambition to project EW at sea alongside KJ‑600 AEW. Catapult‑ready air wings expand launch envelopes for heavier sensors and pods, tightening the electronic warfare arms race in the maritime domain. [10][11]

US Marines push podded EW at the edge

The USMC’s MQ‑9 fleet illustrates a complementary path: modular pods that lift existing UAS into the EW fight. The RDESS/SOAR lineage delivers standoff detection of emitters and, according to Marine leadership, can mimic and return signals in ways that make the Reaper “disappear” from hostile radar pictures. [6][7] Stationed in the Indo‑Pacific, these MQ‑9s provide maritime domain awareness and flexible EW options without waiting for a generational platform reset. [12][13]

Two industrial takeaways follow. First, open, podded architectures are the fastest way to inject disruptive capability at scale across legacy fleets. Second, data governance matters: pods that feed standardised interfaces and mission systems will proliferate; proprietary stovepipes will stall. In a fast‑cycling electronic warfare arms race, integration beats invention when invention cannot deploy.

Procurement: from demand themes to “disruptive fit”

NATO’s challenge underscores a shift away from monolithic demand themes (e.g., “a jammer for X band”) towards mission‑outcome portfolios—detect‑track‑decide‑defeat—composed from interoperable modules. Proposals that foreground AI‑assisted detection, low‑signature tracking, and multi‑kill‑chain handoff will clear evaluation gates faster.

For Türkiye’s ecosystem and European SMEs, this is an opening. COTS‑first sensing, sovereign AI models hosted on edge devices, and turret/pod kits certified to NATO data standards are immediately exportable. As member states re‑arm, those who can demonstrate validated use against fibre‑optic FPV threats and show interoperability with Alliance networks will shape the next lap of the electronic warfare arms race.

Technical focus: cost curves and counter‑UAS

The physics of cost exchange are unforgiving. A $2,000 FPV can force a $200,000 interceptor shot; even when defeated, it drains magazine depth and operator bandwidth. Hence the rise of layered counter‑UAS stacks where short‑range guns, nets, EW, and soft‑kill spoofing precede costly interceptors. NATO’s winners reflect this logic: scalable sensing and autonomous effectors that reduce per‑engagement cost, shorten sensor‑to‑shooter timelines, and preserve high‑end munitions for high‑end targets. [1]

Conclusion: speed of integration is the new offset

EW is no longer a boutique add‑on. It is a contested, iterative arena where adversaries probe, adapt, and redeploy within weeks. The advantage will belong to forces and companies that collapse the time between observation and fielding. That is how the next chapter of the electronic warfare arms race will be written.

Internal link

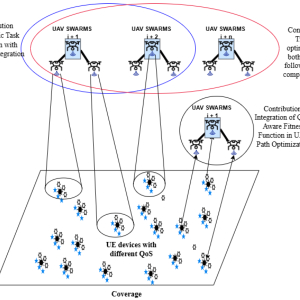

See our related analysis on counter‑UAS concepts and programme dynamics in UAV Swarms vs SHORAD. [14]

External source (original)

This analysis builds upon reporting by Army Technology on disruptive innovation in EW. [15]

Further Reading

- NATO ACT — Innovation Challenge targeting fibre-optic FPV threats and 2025 winners

- Atlantic Council — Fibre-optic drones and the summer offensive

- The War Zone — RDESS/SOAR pod turns the MQ-9 into a “black hole.”

- South China Morning Post — China’s “Storm Eye” concept

- Naval News — Chinese carrier aviation and EW variants

References

[1] NATO Allied Command Transformation: Innovation Challenge—Countering Fibre‑Optic FPV

[2] Atlantic Council: Fibre‑optic drones’ battlefield impact

[3] Washington Post: Ukraine scrambles to overcome Russia’s fibre‑optic edge

[4] SCMP: ‘Storm Eye’ protects friendly signals from jamming

[5] The Defense Post: China’s ‘Storm Eye’ EW concept

[6] The War Zone: MQ‑9 RDESS/SOAR “black hole” description

[7] Business Insider: USMC equips MQ‑9 with EW pod

[8] IISS: China’s Information Support Force (ISF)

[9] Financial Times: PLA reorganisation around information warfare

[10] Naval News: PLAN carrier aviation (J‑35, J‑15DT/J‑15D, KJ‑600)

[11] Army Recognition: Fujian catapult operations

[12] The Aviationist: USMC MQ‑9 with SkyTower II and RDESS/SOAR

[13] UAS Vision: NAVAIR announcement summary

[14] Defence Agenda: UAV Swarms vs SHORAD (internal)

[15] Army Technology: Disruptive innovation in the EW arms race