Edge Group used Dubai Airshow 2025 to show the first hardware from the Edge-Anduril Omen UAV joint venture. The new Omen platform anchors a broader expansion of Edge’s uncrewed portfolio, which now includes three additional systems revealed at the show. Together, they highlight how the group wants to move faster, export more and enter new markets as a perceived local player.

Key facts

- The Edge-Anduril Omen UAV joint venture moved from first contact to signature in about four and a half months.

- Omen is a runway-independent, Group 3 UAV positioned as a disruptive, software-led uncrewed platform.

- Edge also introduced Jernas-M (MALE ISR), Strike (medium-altitude weapon carrier) and Vortex-E (counter-UAS interceptor).

- Edge says around 70% of its UAV portfolio targets export customers, with 30% serving domestic users.

- A US$7 billion deal with Republikorp supports localised defence manufacturing in Indonesia.

- European growth builds on the Milrem acquisition and a new MoU with Indra on loitering munitions and smart weapons.

- Vortex-E weighs 4–6 kg, has a range of up to 24 km and focuses on drone and drone-swarm threats.

Omen JV: software-first design with fast timelines

The Edge-Anduril Omen UAV joint venture sits at the centre of Edge’s new uncrewed strategy. Omen is a runway-independent Group 3 aircraft that draws heavily on Anduril’s autonomy and software stack. Edge, in turn, contributes industrial capacity, regional access and a growing family of complementary platforms.

Company leaders point out that the JV moved from first meeting to a signed agreement in roughly four and a half months. For a defence programme, that timeline looks closer to the pace of a commercial technology deal. Edge and Anduril both present Omen as proof that a Gulf defence group and a US “new prime” can meet in the middle on speed as well as capability.

The partnership also flows in two directions. Edge gains access to Anduril’s software, mission systems and experience in autonomous operations. Anduril gains a manufacturing and industrial base in the Middle East that can build Omen UAVs and related systems at scale. This mutual dependence defines the Edge-Anduril Omen UAV joint venture and shapes its long-term logic.

Both sides also see the JV as a platform for future products. Edge frames Omen as a building block in a wider family of runway-independent aircraft and teaming concepts. Anduril gains another test case for its model of deploying software-intensive systems through local industrial partners rather than direct export alone.

Edge executives argue that Omen shows how quickly they can move from a shared requirement to a flying, export-ready product when the right partner and theatre-driven demand exist.

Industry conversations at Dubai Airshow 2025

Export-heavy portfolio and “local partner” positioning

Edge reports that around 70% of its UAV portfolio now serves export customers. Domestic users account for the remaining 30%. This split pushes the group to move beyond simple platform sales and build long-term industrial arrangements in each region.

The US$7 billion agreement with Republikorp in Indonesia illustrates this approach. Rather than only shipping finished systems, Edge will help stand up localised defence manufacturing in-country. Indonesia gains jobs, skills and some sovereign control over its supply chain. Edge, in return, secures a deeper footprint in a key Indo-Pacific market.

In Europe, Edge follows the same pattern but with different tools. The group acquired Milrem, a European robotics and autonomous systems specialist, in 2023. That acquisition gave Edge instant access to EU-based engineering teams, supply chains and certification pathways. It also provided a reference case for how Gulf and European industry can share ownership and risk.

At Dubai Airshow 2025, Edge also signed a Memorandum of Understanding with Spain’s Indra Group. The MoU covers the development, production and maintenance of loitering munitions and smart weapons and could grow into another joint venture. Edge executives say they want customers in Europe, South America and Asia to see the group as a domestic-style partner, not just a distant exporter. The Edge-Anduril Omen UAV joint venture fits that ambition by embedding advanced uncrewed systems inside local industrial ecosystems.

Jernas-M and Strike: ISR and strike coverage

Beyond Omen, Edge introduced Jernas-M, a medium-altitude, long-endurance UAV for intelligence, surveillance and reconnaissance roles. The platform aims to deliver persistent ISR coverage, feeding live data into national or coalition command networks. It sits in the same broad MALE category as many Western and non-Western UAVs but plugs directly into Edge’s wider portfolio and data links.

Strike, by contrast, is a fixed-wing UAV focused on weapons delivery. Edge positions it as a medium-altitude, attritable weapon carrier. In practice, that means Strike can complement larger manned aircraft and carry precision-guided munitions into contested or politically sensitive environments. Together, Jernas-M and Strike extend the reach of the Edge-Anduril Omen UAV joint venture by filling out the ISR and strike layers around Omen.

Vortex-E: meeting demand for agile CUAS solutions

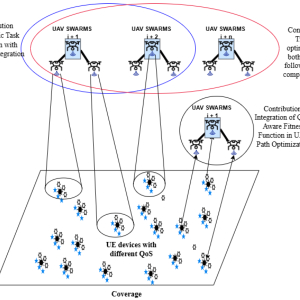

Edge also used the show to introduce Vortex-E, a short-range drone interceptor. The company developed the system in around six months. It weighs between 4–6 kg, offers a range of up to 24 km and focuses on fast manoeuvre against small drones and swarms.

Vortex-E joins Shadow 3, Edge’s earlier VTOL counter-UAS drone unveiled at IDEX 2025. While Shadow 3 provides one layer of vertical take-off coverage, Vortex-E adds a lighter, more agile option for point defence. Operators can deploy it to protect bases, logistics hubs, critical infrastructure or mobile formations where traditional surface-to-air missiles would be too expensive or too slow to react.

Edge says it builds CUAS products around lessons from current conflicts. Commanders now face large numbers of small, low-cost drones, including modified commercial types. In this environment, a flexible interceptor such as Vortex-E becomes a key tool. It allows forces to match low-cost threats with relatively low-cost countermeasures, instead of draining high-end air defence inventories.

Why the Edge–Anduril model matters for future alliances

The Edge-Anduril Omen UAV joint venture has already drawn interest from other major US primes, according to Edge. These companies are now exploring similar structures that mix software-centric design with new manufacturing hubs. For Gulf-based actors, this attention confirms that the region now shapes, rather than only buys, advanced defence technology.

For European and Asian customers, the model offers another sourcing option. Instead of choosing between a single Western or non-Western supplier, they can work with joint ventures that combine design centres, software teams and factories from several regions. That mix could prove attractive in areas such as manned–unmanned teaming, loitering munitions and scalable counter-UAS networks.

Dubai Airshow 2025 therefore marks more than a set of product launches. It shows how Edge wants to be treated as a system-of-systems integrator and a long-term industrial partner. Omen, Jernas-M, Strike and Vortex-E, framed by the Edge-Anduril Omen UAV joint venture and a growing web of export-driven deals, are early test cases. Their success or failure will influence how future alliances between Gulf, US and European defence players take shape.